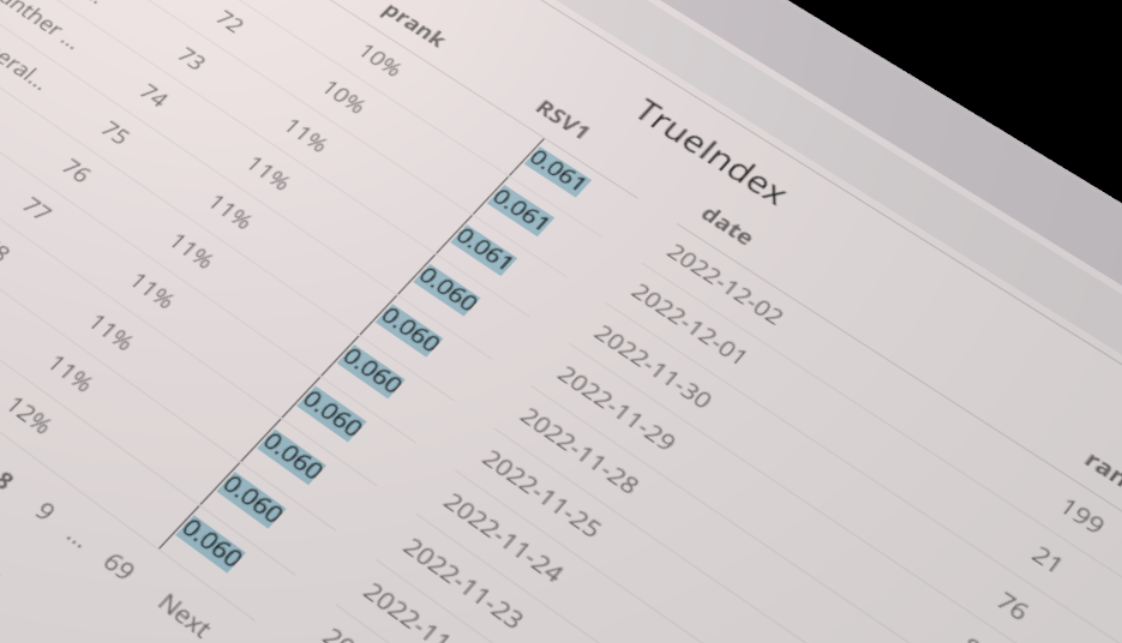

TrueIndex

SilverQuant’s flagship TrueIndex algorithm is the essential tool for investors seeking an optimal stock index for the precious metals sector. Unlike market-cap weighted indices that are of little use for junior mining investors, TrueIndex maximizes market responsiveness, giving deep insight into the juniors and aiding portfolio design.

TrueIndex identifies the most exciting companies in the sector, including explorers and developers, by focusing on price behavior rather than market cap. By ignoring market cap, TrueIndex is able to identify those stocks that move together most strongly, providing investors with a greater risk/reward tradeoff than that offered by large caps.

Investors can use TrueIndex to identify miners that have reliably exhibited sensitivity to the sector, which may be expected to outperform in a general bull market and underperform in a bear market. This makes TrueIndex ideal for aggressive investors seeking maximum exposure but also conservative investors desiring capital-efficient hedging.

TrueIndex is constantly evolving to adapt to changes in the market. SilverQuant provides tools that track the history of how the index has evolved over time, which can help investors gain a deeper understanding of market trends and identify persistent characteristics.

Sign Up Now

Contact us at silverquant.info@gmail.com