Leverage Model

Leverage is a key characteristic of mining companies that can greatly impact their performance. High-leverage companies can offer significant potential for returns but also come with greater risk. For more conservative investors, low-leverage assets may be a better fit.

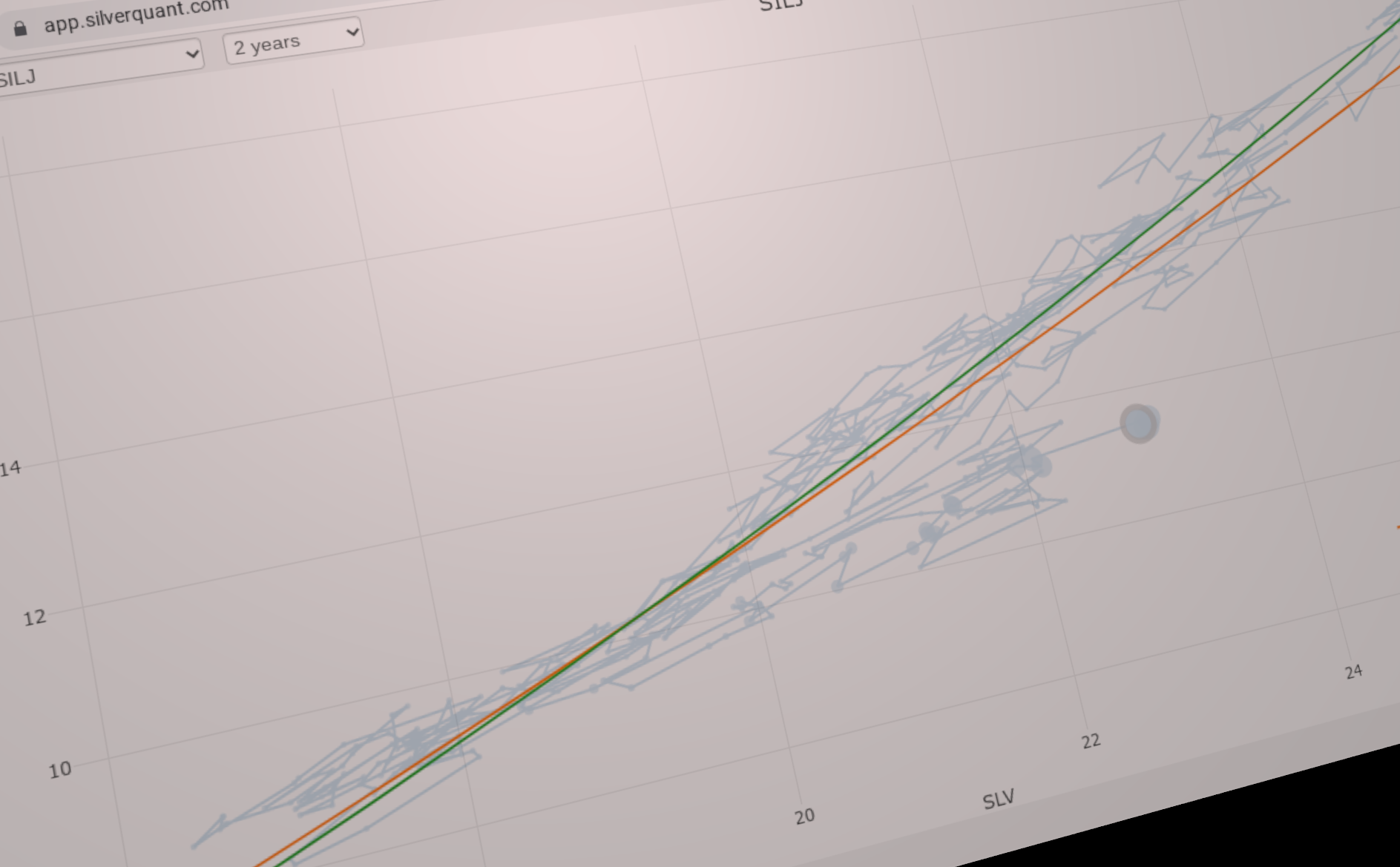

Traditionally, estimating leverage involves cash flow analysis, which can be difficult for early-stage explorers and developers without a mining plan. SilverQuant takes a different approach by estimating leverage directly from market data. Our leverage models compare the price changes of the stock to the price changes of the metal, providing a more accurate and real-time estimation.

In addition to estimating leverage, our models yield other valuable insights. For example, the goodness-of-fit value describes how tightly an asset price is coupled to the metal price, regardless of the leverage value. This can provide investors with a degree of confidence about whether an asset is likely to respond in a metal bull market.

To help investors stay on top of market trends, our leverage models also provide a daily pricing signal that measures the divergence of today’s price from the observed trend. We offer daily alerts based on this signal, which can assist in transaction timing and provide a rough valuation guide.

It’s important to note that while leverage models provide a valuable tool for investors, they cannot capture underlying business successes and failures. For example, a major discovery could cause a miner’s price to soar even during a downtrend in the metal price.

Sign Up Now

Contact us at silverquant.info@gmail.com