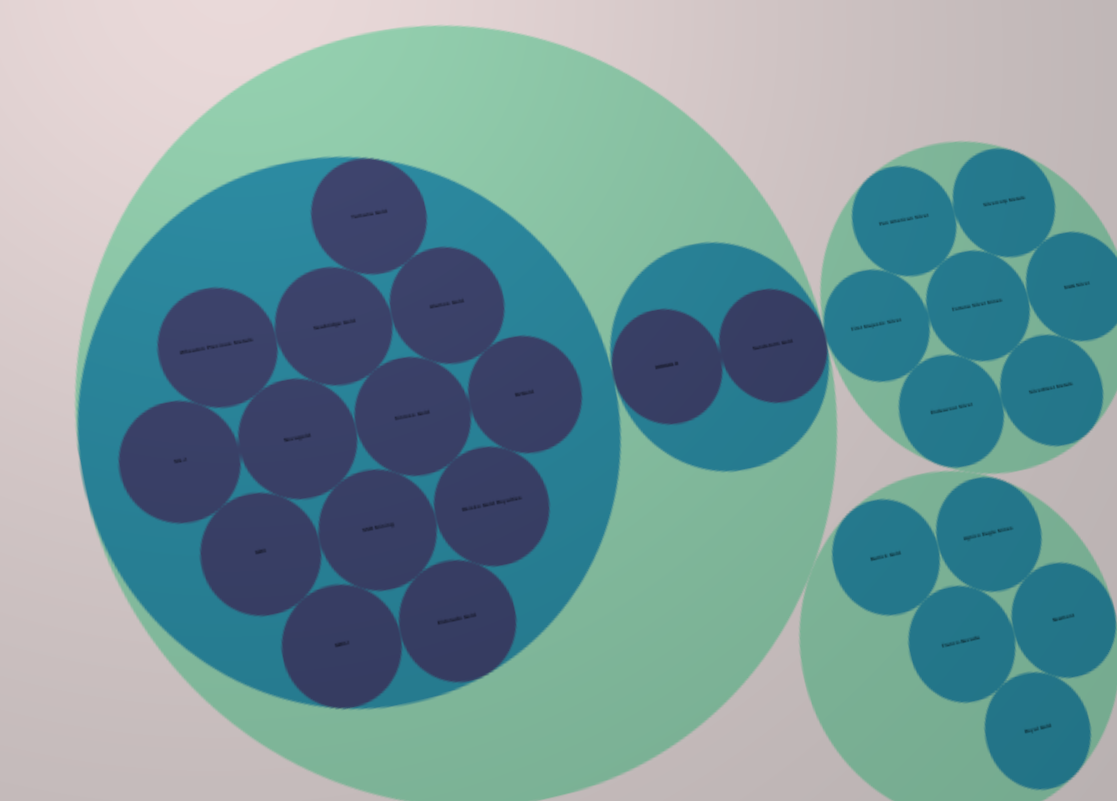

Cluster Explorer

Clustering is a powerful technique for stock market analysis, allowing investors to identify groupings of similar stocks and gain insights into the structure and organization of different sectors. For example, in the precious metals mining sector, Cluster Explorer can reveal sub-sectors that exhibit significant copper exposure. By examining these groupings, investors can identify potential opportunities and risks that may not be immediately apparent.

For analysts with prior knowledge of the market, Cluster Explorer can be especially valuable. By comparing new potential investments to known stocks, analysts can use the tool to identify stocks with similar characteristics and behaviors.

When using Cluster Explorer, it’s important to vary the control parameters to explore different groupings. The tool provides controls for adjusting parameters such as maximum intra-cluster variance. By experimenting with these controls, analysts can identify the most meaningful groupings and gain insights that might not be evident from a single approach.

Comparing and contrasting different groupings can help investors to identify consistent patterns and extract meaningful information from the data. It can also help to identify outliers, anomalies, and noise that may be present. For example, if a stock is consistently identified as an outlier across multiple groupings, it may be a sign that the stock warrants further investigation.

Sign Up Now

Contact us at silverquant.info@gmail.com