Quant Tools

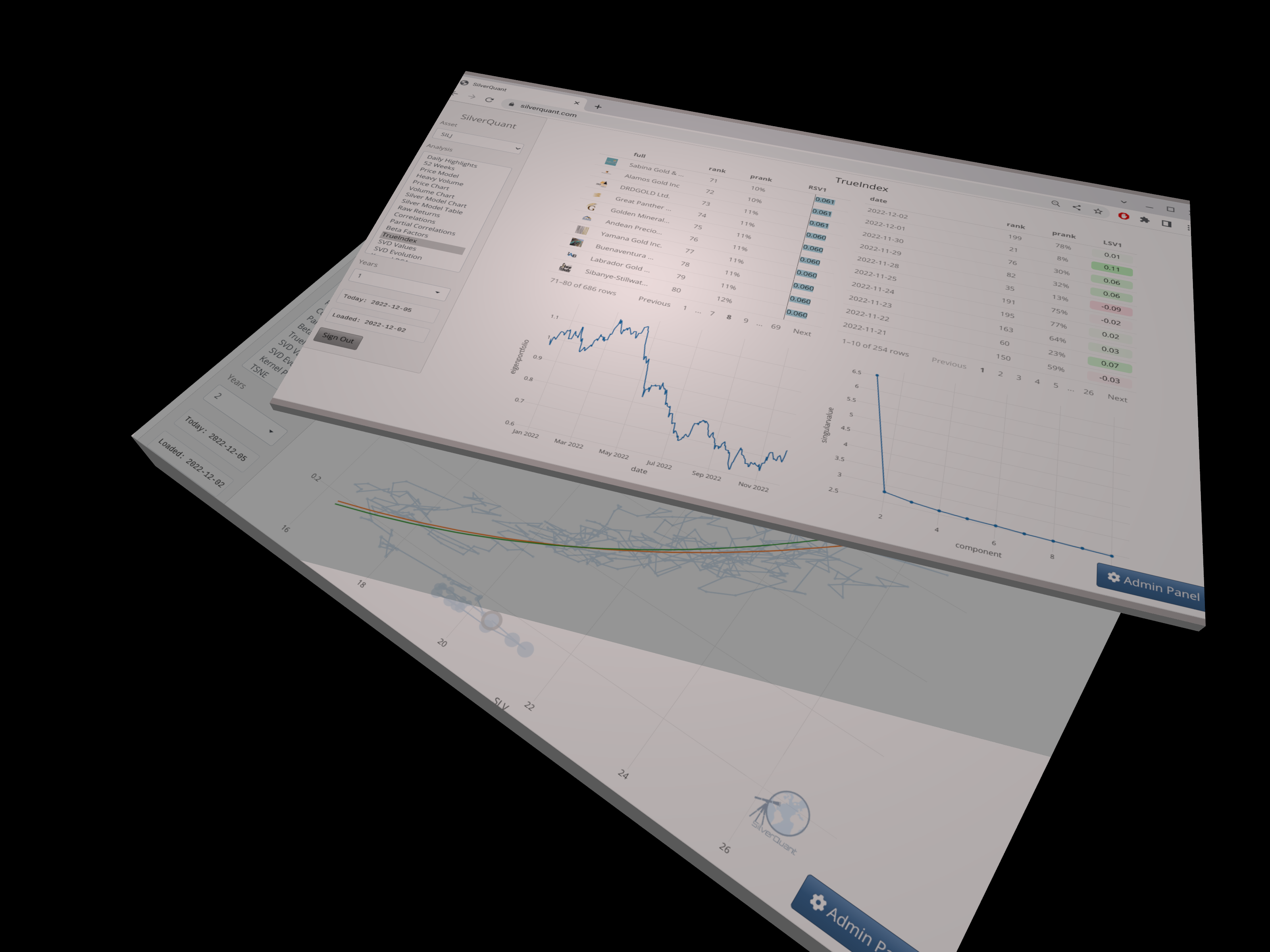

Experience a new level of insight into the precious metals mining market with SilverQuant. Our platform provides over 24 unique analyses that provide a comprehensive understanding of market trends and opportunities. By analyzing mining data, we reveal hidden patterns and deliver actionable insights that help you make informed investment decisions. Discover a better way to analyze the precious metals market with SilverQuant.

- Daily quant signals

- Leverage model signals

- Price model signals

- Volume model signals

- Importance ranked

- Silver leverage model

- Daily price quant signal

- Predictability measure

- Silver leverage estimates

- Ordinary least-squares

- Robust Theil-Sen method

- TrueIndex alternative asset index

- Identifies the most exciting juniors

- Not marketcap weighted

- Continuous updates

- “Signal strength” evaluation

- Performance tracking

- TrueIndex sparse portfolios

- Small portfolios that optimally approximate TrueIndex

- Fewer required transactions

- Adjustable portfolios sizes

- Asset price model

- Daily valuation quant signal

- Predictibility measurement

- Cross-validation optimized regularized models

- Volume tracking

- Negative binomial model

- Unique heavy-volume quant signal

- Beta factors

- Classical capital asset pricing model (CAPM) values

- Multiple reference choices

- Also includes commodity betas

- Market taxonomy tree

- Minimum spanning tree

- Multiple distance metrics

- Asset clustering

- Identify market segments

- Cluster exploration interface

- Asset network

- Partial correlation estimates

- Graphical lasso

- Influence graphs

- Visual Asset Screener

- Parallel coordinates visual screener

- Linked tables

- Nonlinear dimension reduction market maps

- Kernel PCA

- T-SNE

- UMAP

- 2D and 3D views

- Dollar-neutral methods

- Compositional analysis

- Ternary plots

- Heatmaps

- Raw data

- Correlations

- Over two dozen analyses!

Sign Up Now

Contact us at silverquant.info@gmail.com