Silver Model

For commodity producer investors, leverage is an important consideration because it affects the producer’s exposure to the commodity market. For example, a producer with a high level of leverage is more sensitive to changes in the price of the underlying commodity, and may therefore experience larger swings in its financial performance. This can increase the potential risks of investing in the producer, but can also provide the potential for higher returns if the commodity price increases.

On the other hand, a producer with a low level of leverage may be less sensitive to changes in the commodity price, and may therefore experience more stable financial performance. This can reduce the potential risks of investing in the producer, but can also limit the potential for high returns if the commodity price increases.

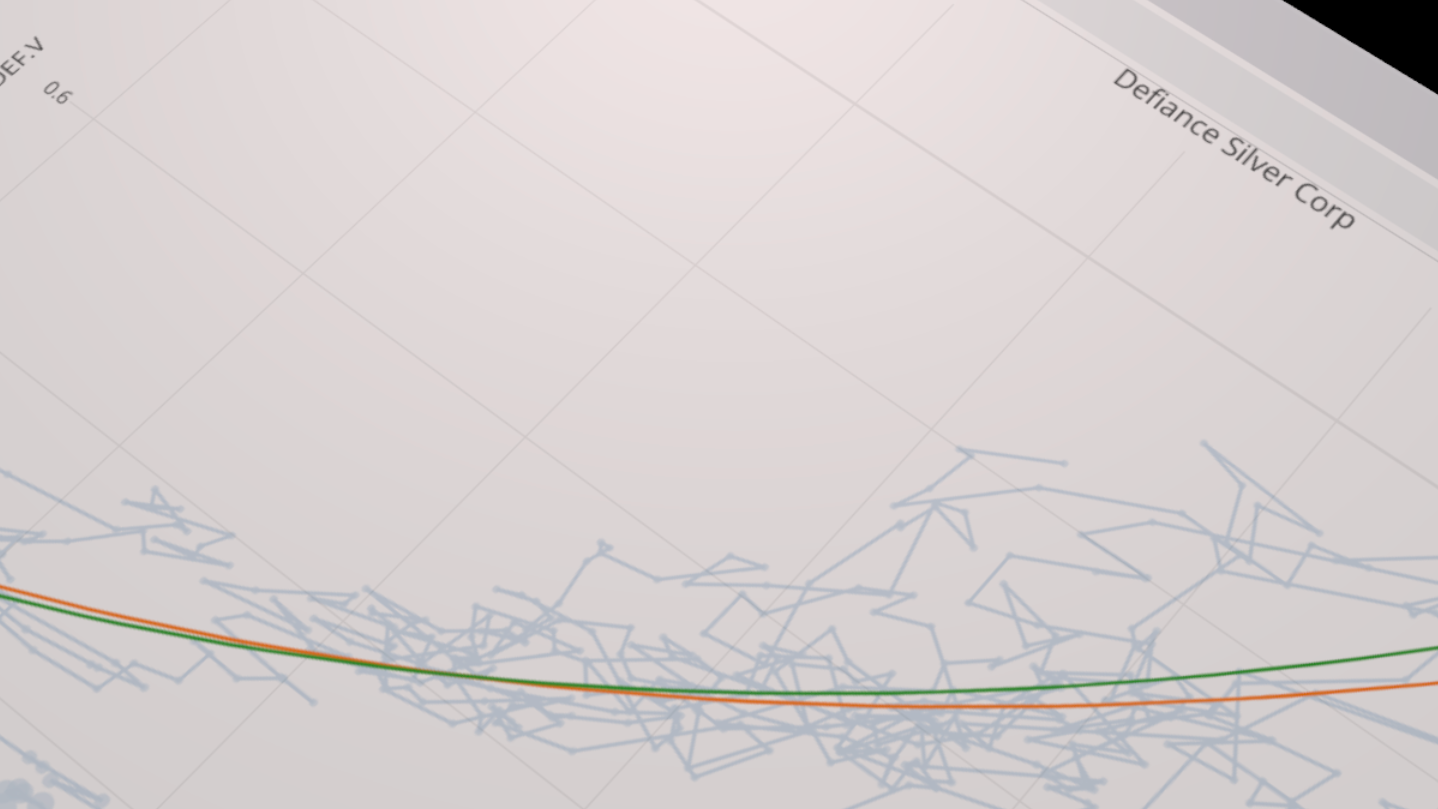

Leverage is typically estimated from cash flow analysis. SilverQuant takes an alternative approach by estimating leverage factors directly from market data by fitting different leverage models. This approach compares the price changes of of the stock to the price changes of the metal.

In addition to leverage factors, SilverQuant quantifies indications of how well the model matches the data, and also compares the current price to that model which can be useful for transaction timing.

Join Waitlist Now