SilverQuant

Precious Metals MiningInvestment Analytics

"The price system can aggregate and transmit knowledge which we could not otherwise convey" -Friedrich Hayak

Guiding Principles

The current inflation fundamentals create a historic opportunity in the precious metals sector.

Market prices contain valuable information to inform investment decisions.

We use celebrated data analysis methods from across academia and industry.

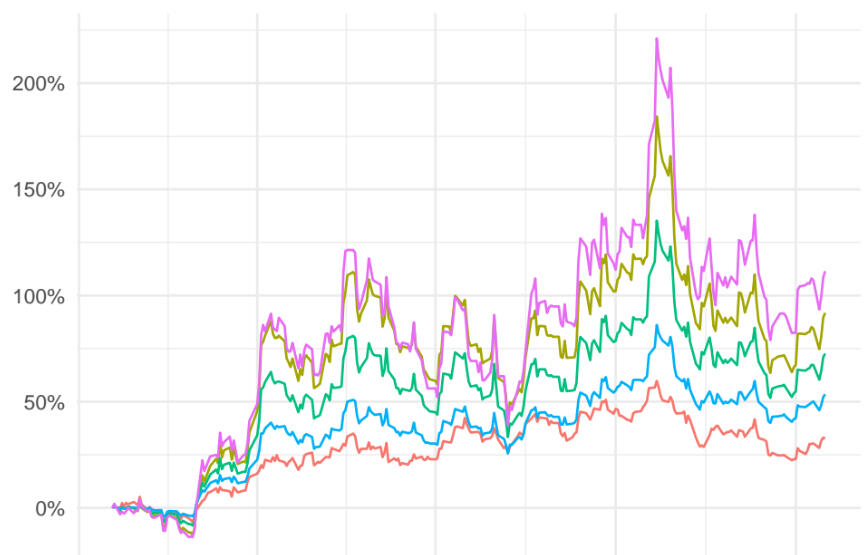

Calibrated Exposure Portfolios

Semi-Passive Strategies

Use the power of non-marketcap indexing to build your high performance portfolio. Choose your exposure level. Our proprietary risk combinations outperform GDX with less volatility.

Semi-Passive Portfolio One Pager

TrueIndex

Optimal Sector Index

Our TrueIndex offers a more-useful index to junior mining investors.By utilizing an algorithm that ranks stocks based on behavior rather than size, our approach identifies the best sources of precious metals exposure.This gives you more upside with less capital and without relying on leverage.

Semi-Passive Portfolio One Pager

Von Mises Legacy

Did You Know?

Ludwig von Mises' younger brother Richard von Mises was an accomplished scientist and mathematician who made numerous contributions to many fields.He is credited with inventing the Von Mises Iteration algorithm for the calculation of the eigenvectors of a matrix.His method is famously used by Google's PageRank algorithm as well as Twitter's recommendation system.SilverQuant uses related techniques to compute the optimal precious metals sector index.We are honored to combine insights from both brothers to protect and grow your savings.

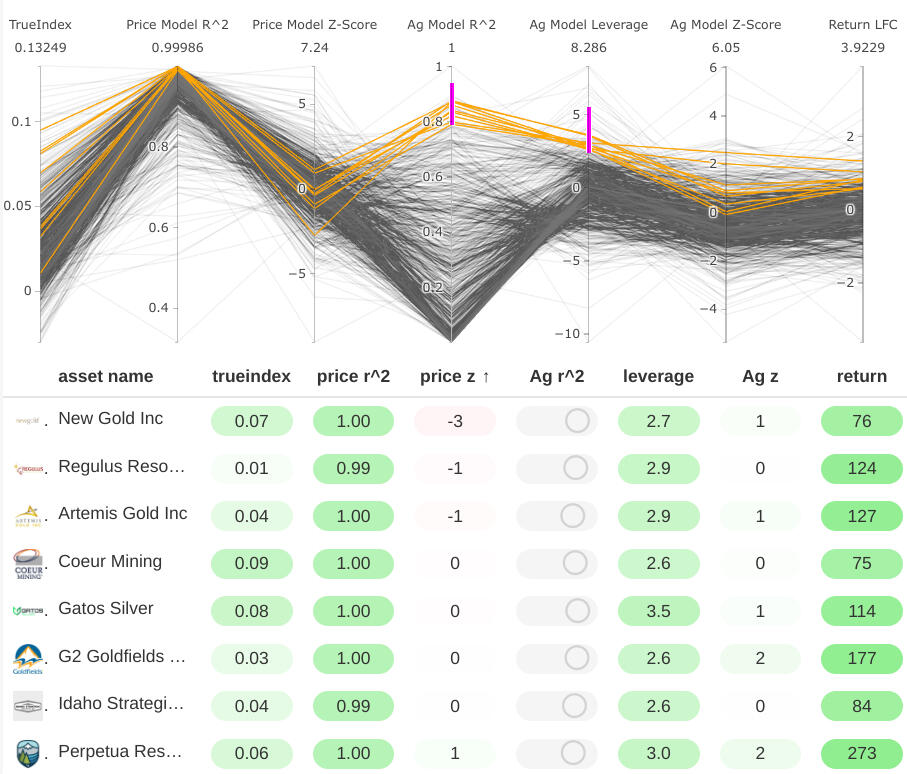

Metal Leverage Models

Measured Leverage

Mining stocks with high leverage see large price gains when metal prices rise. At SilverQuant, we use statistical models to measure leverage factors directly.Our special visual stock screener lets you compare these results across over 900 mining companies, making it easy to find companies of interest.

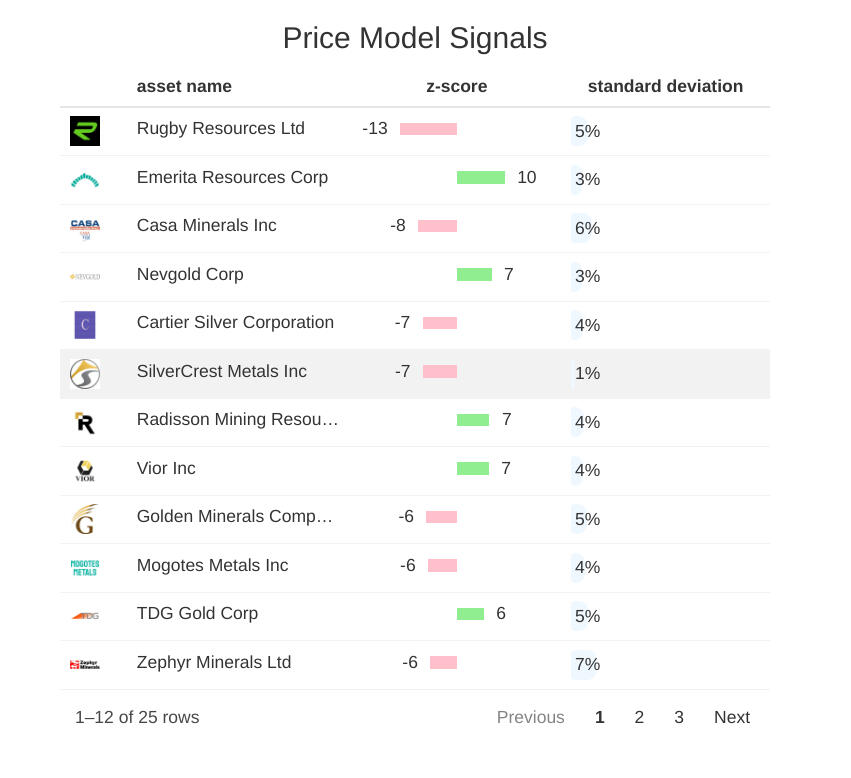

Entries and Exits

Spot Unusual Market Activity

We guide you to important market movements without the hassle of constant monitoring.Our price models identify unusual activity within the sector, providing insights that go beyond simply tracking gainers and losers. An unchanged stock price might be big news on a day when the sector rallies hard.Save time and find entries and exits you may have missed.

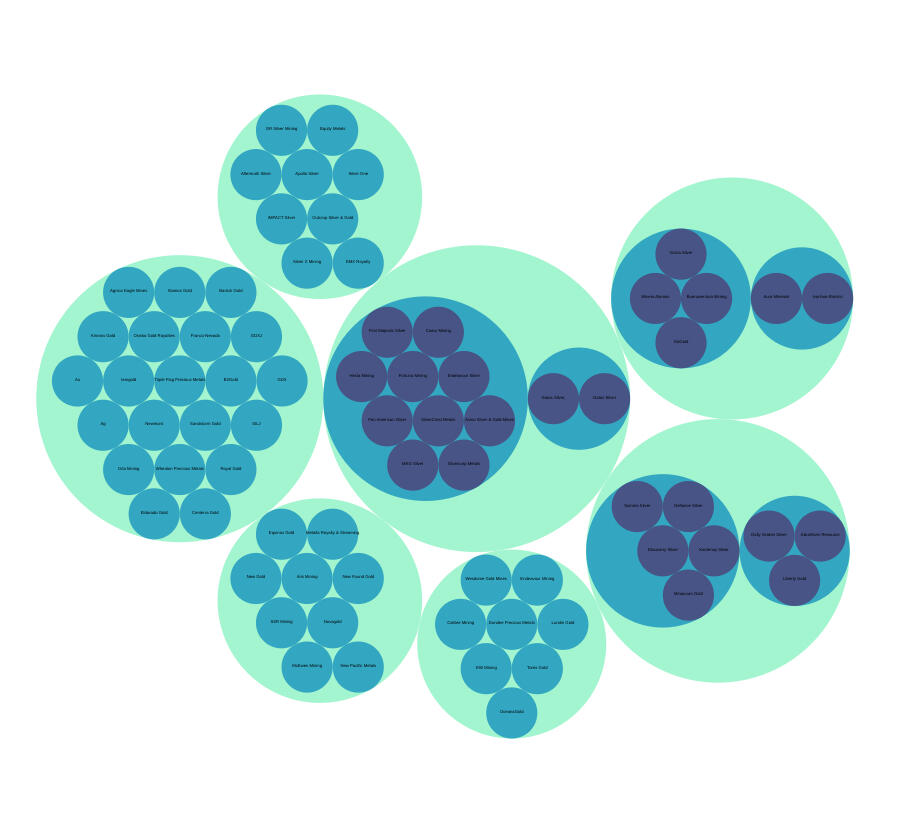

Interactive Clustering

Explore The Market

Our clustering tool helps you visualize how assets within the sector are related, making it easier to identify new opportunities.Maybe you'll be surprised to see a gold miner grouped together with copper producers. Expand your knowledge by exploring the market with our engaging interactive tools.

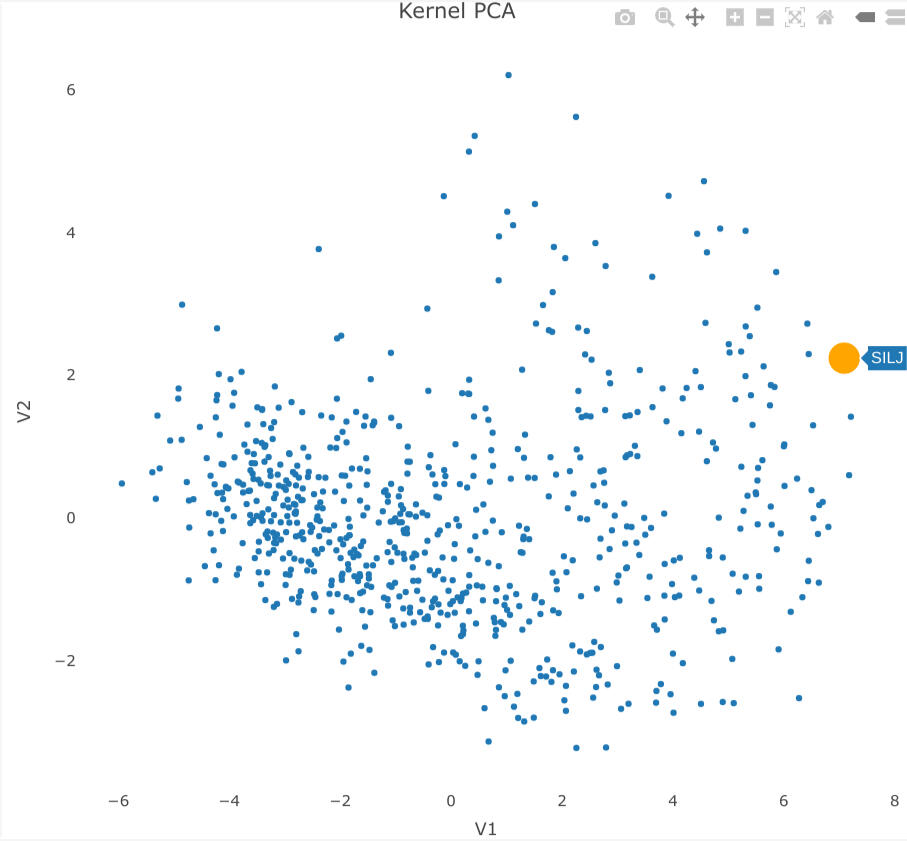

Data Simplification

Commanding Views

Imagine condensing a year's worth of market action for 900+ miners into a single interactive view.Our advanced algorithms simplify millions of data points while preserving the most essential information, giving you sweeping views of the mining market landscape.Gain expert-level comprehension at a glance and instantly understand the variety of investment options available to you.

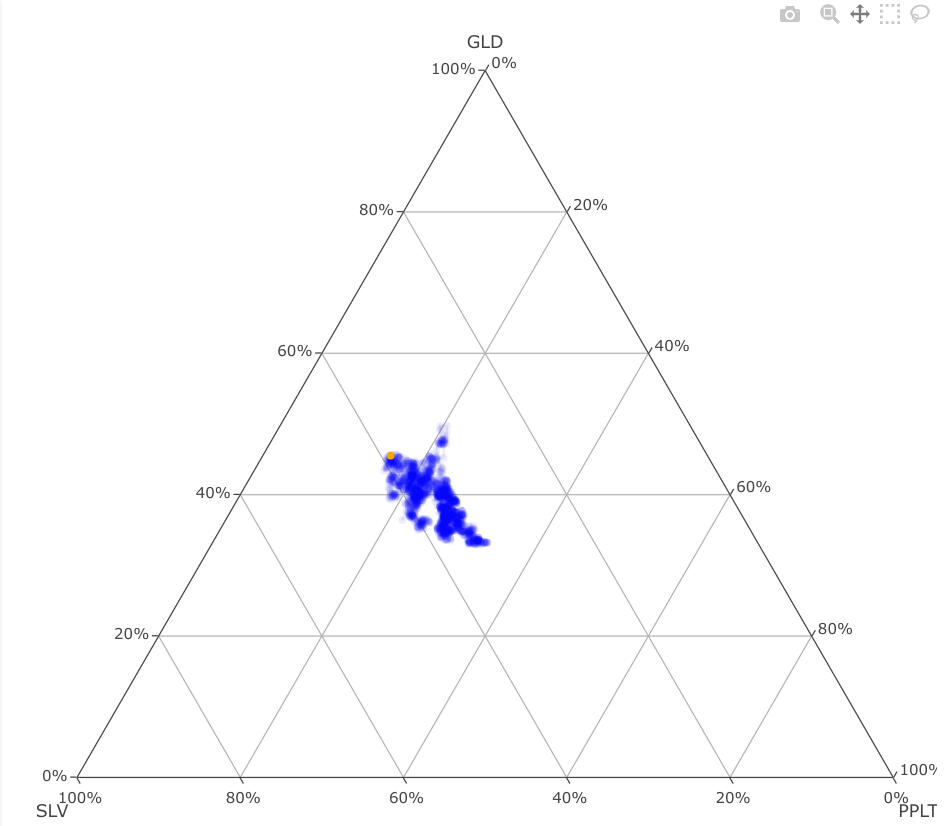

Factor Out Fiat

Beyond The Gold/Silver Ratio

When money is failing, precious metals investors rely upon price ratios to gauge relative valuations. Use our compositional data analysis to compare relative valuations of more than two assets simultaneously.

Over A Dozen Analysis Methods

Remarkable Insights

Asset networks, market taxonomy, 3D rotatable visualizations, visual stock screener, commodity beta factors, and much more.We provide user friendly explanations for every analysis without resorting to jargon or math. We get straight to the point, with plain language interpretations.

Get Started

Contact Us

Send Us A Message

Semi-Passive Portfolio One Pager

© 2025 SilverQuant LLC. All rights reserved.